Probate: Timescales and Pricing

Coping with the death of a close relative is a difficult time anyway. Dealing with all the legal requirements of wills, inheritance and probate can make it even harder.

Where a will is in existence, the Executors will need to apply for the Grant of Probate to give them the legal right to administer the estate. Where no will exists, the will is invalid or it does not specify an Executor, an Administrator will need to be appointed.

Administering and distributing an estate comes at a time of grief and high emotion, and the processes and legal steps involved can be confusing. Although individuals can take on the burden of obtaining a Grant of Probate themselves, it’s often easier to let a professional handle the stress.

We can help you at this time by obtaining the Grant of Probate on your behalf. We will also undertake the collecting and distribution of assets and as part of the fee we will:

- Identify the legally appointed executors, administrators and beneficiaries

- Identify the type of probate application you will need to make

- Obtain relevant documents required to make the application

- Complete the Probate Application and relevant HMRC Forms

- Draft a Legal Oath for you to swear

- Make the application to the Probate Curt on your behalf

- Obtain Probate

- Collect and distribute all assets in the estate

Timescale involved

Obtaining probate for the typical estate can take anywhere between 3 to 12 months. It usually takes 3 to 6 months to obtain a Grant of Probate, while collection and distribution of the assets can take a further 4 to 12 months. More complex estates may take longer, and we would inform you if this is likely. Key milestones in probate to follow are:-

- Applying for a Grant of Probate

- Obtaining a Grant of Probate

- Settling Liabilities

- Collecting funds ready for distribution

- Distributing funds

- Producing Estate Accounts

Pricing

The fees involved in a probate matter can vary, and will depend on individual circumstances.

We offer both fixed fees and an hourly charging rate, which charges per hour of work undertaken.

Range of Costs

Our legal fees vary, and are dependent on individual circumstances. Our fees vary between £1,200 to £7,000 plus VAT and disbursements. There may be a value added element depending on the complexity of the matter of not more than 1.5%

Fees vary according to the number of beneficiaries and whether a property is involved. Fees typically increase if there are multiple bank accounts, shares, or multiple properties involved.

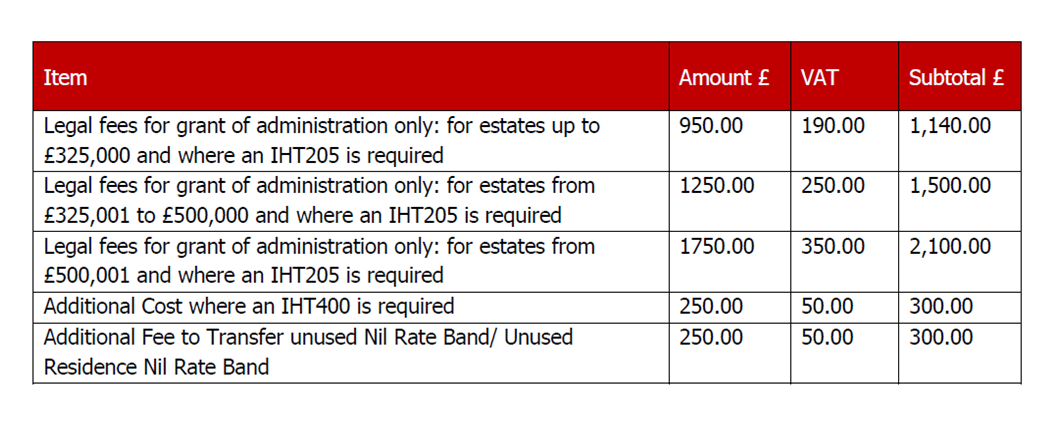

Fixed Fee Probate

We can obtain the Grant of Probate on your behalf for a fixed fee. The fees rely upon you collating the information to the value of the estate and we will complete the probate application and relevant HMRC forms. Upon receipt of the Grant of Representation we will pass the original and sealed copies to you to administer the rest of the estate yourself, unless you wish us to administer the estate as per the pricing section below.

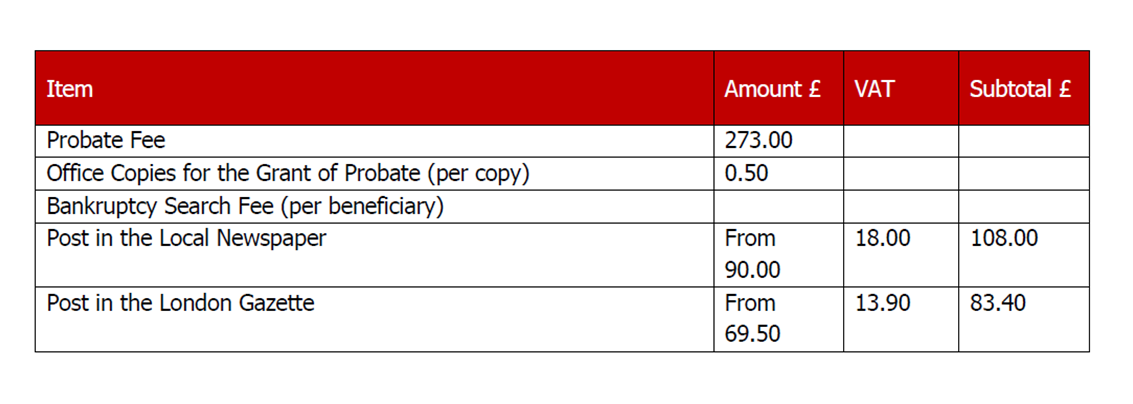

Disbursements

Disbursements are specific fees that are payable to third parties, such as Land Registry or Court fees. We can handle the payment of disbursements on your behalf to ensure a smoother process. Anticipated disbursements are shown in the table below. Please note that the Probate fee is likely to be increased at any time on fairly short notice.

Disbursements are specific fees that are payable to third parties, such as Land Registry or Court fees. We can handle the payment of disbursements on your behalf to ensure a smoother process. Anticipated disbursements are shown in the table below. Please note that the Probate fee is likely to be increased at any time on fairly short notice.

Inheritance Tax

Inheritance Tax is payable on any estate worth over . Calculators to help work out likely Inheritance tax using online Government guidelines may be done at:

https://www.gov.uk/guidance/hmrc-tools-and-calculators#inheritance-tax-and-bereavement

Additional Costs

An estate where there is no will, or which contains any share holdings may incur additional costs which will vary depending on the size and situation. We will advise you of any additional fees necessary.

The cost of selling or transferring a property is not included in our service price. Please let us know if you require help with this.

Additional copies of the Grant of Probate will be charged at £0.50 per copy or per asset.